Please contact a knowledgeable estate planning professional to ask what type of charitable bequest or gift will benefit you the most.

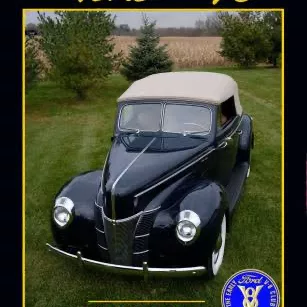

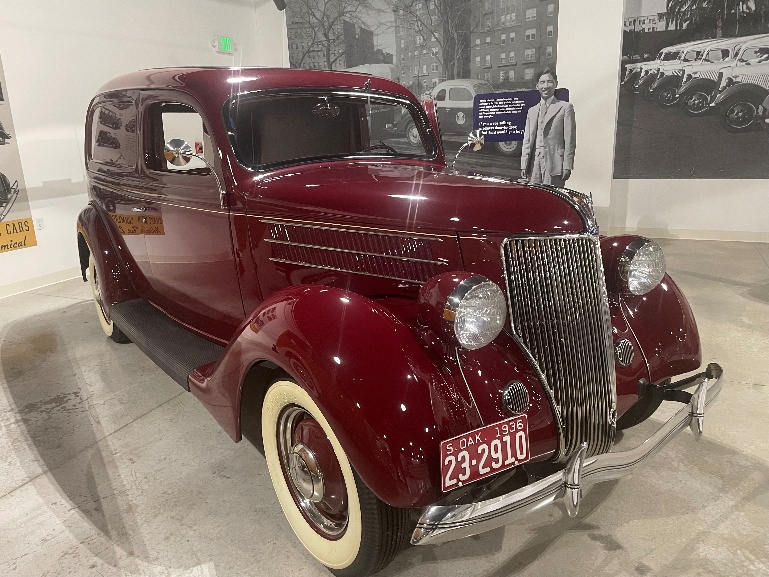

Early Ford V-8 Foundation Museum

Planned Giving

Opportunities With The Early Ford V-8 Foundation Museum

Planned giving is a simple concept. It means that someone is giving a gift to an organization whose goals and objectives they support and is doing this in a manner that maximizes tax and other financial benefits. A planned gift is typically a gift of an asset or income. Remember to include us in your written plan, or this is what could happen:

- Your collection of Early Ford cars, trucks, and memorabilia could go to the wrong person or organization.

- Your estate could pay more than necessary in administrative costs

- You may miss out on some significant estate-tax savings opportunities available to you

- please speak to our director at 260-927-8022 for more information on planned giving

Bequests, legacies, devises, transfers, or gifts to a 501(c)(3) entity, such as the Early Ford V-8 Foundation Museum, are tax-deductible as determined by the Federal Estate and Gift Tax Act, if they meet acceptable provisions. Charitable gifts include such things as:

- Gifts of cash, stocks and bonds, savings certificates, commercial annuity contracts, and funds held in an IRA. By naming the Early Ford V-8 Foundation as a primary or secondary beneficiary on an IRA, you would get a charitable donation write-off and avoid paying taxes on the IRA or on withdrawals made from the IRA by the Early Ford V-8 Foundation

- Tangible property, such as Early Ford V-8 cars and trucks as well as memorabilia are wonderful ways to show your appreciation for what it has meant to you to be involved in Early Ford V-8 restoration, driving, and socializing.

- Deferred giving through Insurance policies or annuities (simply name the Early Ford V-8 Foundation Museum as a beneficiary)

- Gifts designated in memory of someone or to honor someone

- Workplace Giving: Many employers are willing to match your gift to a non-profit organization as part of their charitable donation programs

- Appreciated real estate, if owned more than one year could be of sizable help to the Early Ford V-8 Foundation in generating endowments and working capital

Planned Gifts in support of the Early Ford V-8 Foundation offer:

- A current income tax deduction

- Increased cash flow from an asset, sometimes at a more favorable tax rate

- Preservation of an asset, coupled with the elimination, reduction, or deferral of capital gains

- Professional management of an asset

- Gift and Estate Tax savings

- Please contact your estate planner or accountant for specific benefits

Museum Select Motors

Museum Select Motors is a service garage and an auto dealership on our campus that will help you sell your vehicle for an 8% consignment rate! We sell any make, model or year, although we do typically have more classic cars in our inventory. Click the link to the official MSM website to view current inventory, read how consignments work, and even make appointments with the service garage!

Upcoming Event Explore All Event

Fall Swap Meet 2026

Start : Thurs. Sept 3

End : Sat. Sept. 5

Venue Location :

Early Ford V-8 Museum

Do you have your venue for your upcoming Graduation Party or Wedding Reception yet?

Start : Feb. 14

End : Feb. 14

Venue Location :

J. Windle Event Center on Early Ford V-8 Museum Campus

The Ford Store

Featuring museum branded apparel, automobilia, books, automotive literature, archives, and much more!